Image source: https://image.slidesharecdn.com/financefinancialcrises-160830103629/95/financial-crises-8-638.jpg?cb=1472553471

The truth is, we are going inside of the strategy the maximum serious global financial crisis pondering the times of Great Depression. Originated in USA, economic recession is affecting the complete primary players of world economy. Governments and primary coverage makers of world economy have taken notice of the urgency of the scenario and frantic steps are undertaken to stem the rot. At the middle of the term recession, spirals of a host of financial mistakes are intermingled.

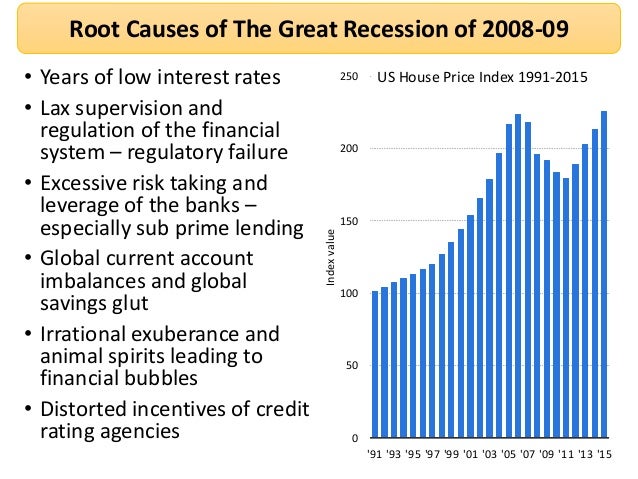

The largest bother with economic turmoil is; it creates fear and panic amongst intensive-unfold people. Rumors are thick and they fly, resulting into even more fear amongst the families roughly their less pricey cost premiums and frustrating earned revenue. Economic bother of 2008 is of gigantic proportions. If we visible attraction closely on the bother, we find few obligatory factors. Foremost among them is, complacent regulatory norms in USA. USA has enjoyed sustainable economic building with cushion of low inflation premiums over last two a lengthy time. This resulted into entire lack of understand-how of a ought to-have manufacturer cycle of economy. The first indicators of this bother were visible 20 months ago at the same time America used to be combating extra liquidity accessible inside of the market. That used to be an plentiful signal of coming of genuine estate bubble and asset fee inflation.

Another guilty point is cushion enjoyed by non-public and investment banks. Taking their cue from brilliant economic scenario, maximum of these high flying banks took more favourable dangers. Most in their manufacturer bargains were extraordinarily leveraged transactions. The taste of threat undertaken by investment banks proved to be their nemesis as they did not gather adequate capital to help their dicy investments. Third guilty point is dimension of investment banks. Many of them witnessed tremendous improvement at the same time economy used to be on the rise. They made tremendous profits in step with their high threat propensity ventures. These FIs (financial associations) also contributed closely to US corporate profits.